Organizations

Global Business Risk Index

Evaluate current and emerging international risk factors affecting global organizations across different sectors. This will allow you to adjust course and plan for what’s to come

A New Way to Understand Exposure

In a world where risk is around every corner, having clarity and thinking ahead are essential for the success of your international business. The Global Business Risk Index gathers critical risk data from your organization and uses it to provide a holistic picture of the current and future liabilities affecting your industry. Reviewing this data allows you to adjust course now and plan for what’s to come. We reformatted the Risk Index so you can review the most up-to-date data around the clock and stay current on every factor affecting your worldwide operations.

Who is the Business Risk Index For?

Risk managers and decision makers can use the index data to evaluate current and emerging international risk factors affecting their organization, including top concerns, categories of loss and levels of preparation for different risk types.

Did You Know…

That in 2018, cyber liability was a top concern among business risk managers?

More than 25% of respondents said their organization experienced a cybersecurity breach.

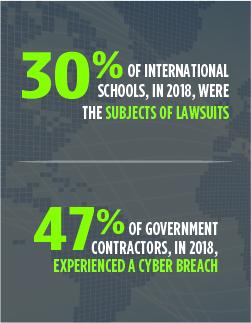

For certain industries, this number was much higher? Our data shows that 30% of respondents from International Schools were subject to lawsuits.

Government Contractors are another industry with cyber liability concerns. 47% reported experiencing a cybersecurity breach.

Help Us Help You

So, where do we get our worldwide data for this Risk Index? From leaders and managers like yourself. By taking the Global Business Risk Index Survey, you can help provide decision-makers in your organization, who specialize in global risk management, with timely, relevant, and practical data regarding current, potential and future liabilities. Additionally, the survey combines data across different sectors, giving you insights into what others in your industry are experiencing.

Our Commercial Insurance team uses this data to better understand our customers’ needs which helps them create customized and appropriate international business insurance solutions.

Fill Out the Global Business Risk Index Survey

It is completely anonymous and only takes about ten minutes to complete.

By submitting your responses, you are helping create a more holistic picture of global business risks and gaining a better understanding of your industry’s specific concerns regarding worldwide risk management.

Need Immediate Assistance?

If you have questions, you can reach us via email at clements@ajg.com or our contact form and one of our Commercial Insurance Advisors will be happy to assist you.

Get Notified When the Survey Results are Here!

Once results become available, we will share key insights with you and discuss any concerns about what the data reveals.