Organizations

Types of International Insurance for Your Employees Working Abroad

When thinking about international insurance, many employers think about companies with offices, factories, or warehouses in multiple countries. But not all companies with international risks are the same, and some have significant international exposures without ever opening physical locations outside of their home country.

The Engineering News-Record Publication states that the top 250 international contractors reported $473.07 billion in contracting revenue in 2019 from projects outside their home countries, down 2.9%, from $487.29 billion in 2018. These contractors focus on large construction and infrastructure projects, but much smaller companies around the world are traveling outside of their home country to undertake work on a contract basis, often as subcontractors of a larger company. These could be electricians, security companies, equipment installers, skilled cabinet makers, or IT companies.

What are the Best Insurance Policies for Working Abroad?

Which policies will best cover employees working abroad will certainly depend on what type of work these employees will be doing and where they are going. So, what types of specialized insurance should a company offer these employees?

In this article we take a closer look at:

- Liability Insurance Abroad and at Home

- Admitted vs. Non-Admitted Insurance in a Foreign Country

- What to Consider for Insurance When Working Abroad

- Employee Injuries and Sickness

- Why Do Companies Consider Business Travel Accident Insurance Policies?

- Limitations of Personal Accident and Foreign Voluntary Workers Compensation

- Defense Base Act Insurance

- International Health Insurance

- Kidnapping

- Summary

Let’s look at two scenarios:

FixItUp LLC

Type of Work: Building renovation work outside the home country

Contract Length: 2 months

KeepYouSafe Corp.

Type of Work: Security work at a foreign embassy in a country ravished by conflict

Contract Length: 12 months with probable extension of 12 months

Liability Insurance Abroad and at Home

Could your employees cause injuries or damage property while working? If so, you’ll need to make sure that they have International Liability Insurance policies in place that will cover incidents outside their home country. Would they be sued in the country where the incident happens, or would the suit be brought back to a court in their home country? It could be either and you’ll want the insurance to respond in either case, making sure that the policy would respond to claims brought in the courts of the country where the work is taking place, as well as in the courts in the home country.

Admitted vs. Non-Admitted Insurance in a Foreign Country

Many countries around the world have rules prohibiting non-admitted insurance, which is the sale of insurance to people or companies in their country by insurance companies that are not licensed by the country’s insurance regulator.

If a company in country A employs FixItUp for the 2-month contract, should FixItUp obtain local insurance from an insurance company in country A? In theory, maybe they should, depending on the way the laws are written, but in practice it may be difficult for the contractor to secure coverage in a country where they are not a registered company. Unless stipulated in the contract terms, it is unusual for a contractor to obtain locally admitted insurance policies for small, short-term contracts in another country.

For KeepYouSafe Corp. working in another country for a year, the question of whether to buy locally admitted insurance is more complicated, especially if the country where they will be working lacks a strong insurance market.

What to Consider for Insurance When Working Abroad

- Is local coverage required by law? What is common practice?

- Is local coverage required in the contract terms?

- Is local coverage available in the insurance market? If so, is the available coverage adequate in terms of policy language and available limits? Do the local insurance companies have adequate financial strength, reinsurance backing, and professional reputation?

- Is local advice, service, and local claims handling important?

- Is the contracting company legally established in the country?

- Is it politically advisable to buy insurance locally?

- If the work will be on military bases or diplomatic property, do the local laws even apply?

While most people would like the rules regarding admitted versus non-admitted insurance to be black and white, providing good advice to clients is sometimes not that easy and is more nuanced than at first glance.

Employee Injuries and Sickness

If employees are covered by a domestic workers compensation policy, will this policy respond outside of the country? In the United States, most workers comp policies provide some coverage for medical expenses and lost wages while workers are temporarily working outside of the US, but they are not designed with international travel in mind, and they will not respond to employees on long-term assignments outside of the country.

It’s critical for companies whose employees travel overseas to carry insurance specifically designed to respond to medical emergencies occurring during travel.

Even if domestic policies do offer some coverage, they will probably not cover things such as endemic disease or emergency evacuation expenses. If the employee is injured while sightseeing in the evening or weekend, would the workers comp policy respond? Probably not. Would the employer have a legal obligation or feel a moral obligation to assist the employee? Quite likely. For these reasons, many companies buy Business Travel Accident policies.

Why Do Companies Consider Business Travel Accident Insurance Policies?

- Provide emergency medical expenses coverage

- Include helplines and apps to help travelers find medical care

- Cover emergency medical transportation costs if the employee is injured in a remote location

- Include coverage 24 hours a day so that the employee is covered for the duration of the trip, not just during work hours

- Pay monthly or lump sum benefits in the event of a work related injury or death

A Foreign Voluntary Workers Compensation (FVWC) policy will also cover work related injuries to US employees who are working outside of the United States, and it typically mimics the workers compensation benefits in the state of hire of the employee. In some cases, a FVWC policy may provide broader benefits than a Business Travel Accident policy, such as paying a permanently injured employee a percentage of pay for life. A Business Travel Accident policy can cover work related, and non-work related injuries, as well as having more flexibility such as the ability to add coverage for traveling spouses.

Limitations of Personal Accident and Foreign Voluntary Workers Compensation

Are medical expenses from illnesses covered, or only accidents?

- Are injuries occurring while sightseeing covered?

- Will death or injury due to terrorism be covered?

- If an employee requires treatment for Covid-19, are medical expenses for Covid-19 covered or excluded?

- What triggers evacuation coverage?

- Would evacuation due to political upheaval or a natural disaster be covered?

Defense Base Act Insurance

If the contract is with the US government or a US embassy or base, then it is very likely that there will be a stipulation that the contractor must buy Defense Base Act (DBA) insurance. This is a type of workers compensation insurance that all US government contractors and subcontractors working on US military bases or government properties are required to buy. It doesn’t matter who owns the company or what nationality the employees are. If the contract states that Defense Base Act is a requirement, then nothing else will do.

A DBA policy is needed by most contractors working on US Government property outside of the US.

Court rulings over the years have established that DBA coverage can extend well beyond just covering working hours. To be sure that all employees have 24 hour coverage, it would be wise to buy additional Business Travel Accident and Group Personal Accident insurance that will respond to non-work related injuries and provide emergency medical transportation costs and more.

International Health Insurance

From the example companies above, FixItUp is unlikely to buy insurance for routine doctor visits and non-emergency medical coverage for its employees who are away for a month. Most non-emergency visits can be delayed until they get back to the home country.

Do your employees have sufficient work-abroad health coverage for an international assignment?

KeepYouSafe has a longer-term contract and may want to offer routine medical care such as annual check-ups, treatment for allergies, or maternity care in addition to emergency coverage.

If they have a domestic health/medical policy, does that provide sufficient coverage outside of the country? Are their direct pay arrangements with local doctors and providers, or do the employees have to pay upfront and then submit claims?

Is there ‘free’ socially provided healthcare and are foreigners temporarily working in the country covered by this?

An International Health Insurance policy designed to cover expats should be considered if emergency medical treatment is not enough, and the employer wants to offer benefits such as preventative healthcare, vision or dental, mental health treatment, maternity coverage, and more.

Kidnapping

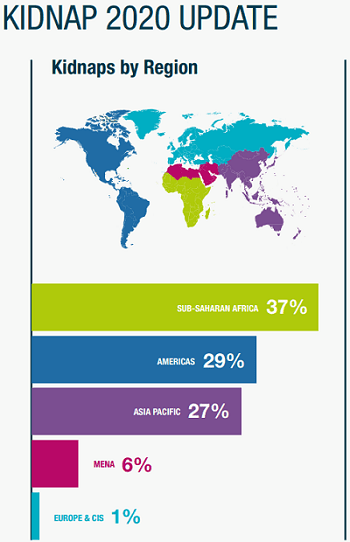

If the contract is in Switzerland, this may not be a concern, but there are certainly parts of the world where abduction is a real threat. Even if a place may seem safe, there is always the threat of virtual kidnapping. Who do you turn to if you are out of the country and you receive a call saying that someone has abducted your children and will hurt them unless you send money to them immediately? Is it real or is it a scam? When a company buys a Kidnap & Ransom (K&R) policy, they are paying for professional advice and expertise as much as for financial protection.

In countries with kidnapping activity, the risk of kidnap increases as the contract duration increases because kidnapping gangs like to have time to research victims and understand their travel patterns so that they can snatch them at the least risky time and place for the gang.

Insurance for Working Abroad in Summary

International insurance is traditionally taught in terms of manufacturers with factories in multiple countries, but companies that cross national borders to work on short- or long-term contracts have their own risks to consider. Improperly reviewing these risks could lead to unexpected surprises, and when it comes to insurance, no one likes surprises. It’s best to plan ahead and adequately prepare for all the types of risks a company may need when sending its workers abroad.

Let’s Connect!

Do you need customized international insurance solutions for your employees?

Clements Worldwide has more than 70 years of experience providing International Business Insurance coverage to organizations around the world. Over the years, we have specialized and developed a range of solutions targeted to cover the organizations’ operations in high-risk and emerging areas. We are here to help you find the right insurance solutions for businesses.

Let’s collaborate to create the perfect customized insurance options that meet your employees’ needs.

Relevant Helpful Resources

Find tips, trends, and perspectives to help you confidently make decisions and navigate challenges internationally with peace of mind. Read how you can live, operate, and manage risks abroad.

International Group Personal Accident Insurance: When DBA Coverage is Not Enough

Created and reviewed by the Commercial Insurance and Underwriting experts at

Separate Fact from Fiction: 9 DBA Insurance Myths to Debunk

When researching DBA insurance, deciphering what’s true and what isn’t can

Achieving Effective Risk Management & Preparedness

Preparing for Risks with Confidence and Clarity Your organization serves with