Organizations

How Employers Can Reduce Health Care Cost Without Losing Employee Loyalty

Getting health care benefits in order is not always an easy task. Organizations face pressure to reduce costs, while workers increasingly value health care benefits as an important component of their compensation.

Balancing each of these realities – the push to cut costs and the pull of employee expectations – requires careful planning to attract new talent and maintain employee allegiance.

As heath care costs continue to rise worldwide, many employers must restructure their health care benefits package to maximize their available budget. This process has been complicated by the COVID-19 pandemic, as the shift to telecommuting has impacted employee expectations. However, thoughtful cost sharing, balanced by flexible options and valued additions such as wellness programs and telehealth, can result in an effective health care benefits program that not only reduces expenses for the organization but boosts employee recruiting and retention.

Here is an overview of the topics we will cover here:

The Employer’s Challenges

Benefits continue to be one of the most important job criteria for employees.

Health Care Cost Cutting Pressures & Trends

The economic reality of rising healthcare costs is already understood by most employers.

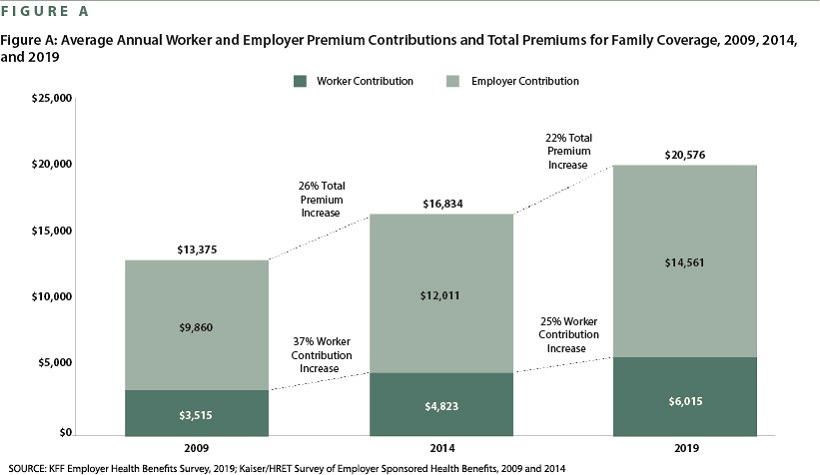

- The average company covers 82% of single coverage and 69% of family coverage, although employee contributions to these plans continue to rise.

- The cost of health care is second only to salaries or wages in terms of overall expense for most employers. Those companies that self-fund a health plan rather than purchasing insurance are directly paying for 100% of these rising health care expenses (Source: AHIP).

According to data from Willis Towers Watson and the Centers for Medicare and Medicaid, although the pandemic created an actual drop in health care utilization and overall spending in 2020 due to a sharp decline in nonurgent surgeries and elective care, this decrease is expected to be short-lived.

- The projected cost of health care benefits globally is expected to rebound +8.1% in 2021. By region, these average increases are expected to be:

- +5.8% in Europe

- +7.3% in the U.S.

- +8.5% in Asia Pacific

- +10% in the Middle East and Africa

- +13.6% in Latin America

- Insurers expect medical costs to continue accelerating over the next three years.

- During this time period, higher medical costs are anticipated by 90% of insurers in the Middle East and Africa, 77% in Europe, and 40% in Asia Pacific.

- From 2020-2027, the cost of private health insurance spending in the U.S. is projected to increase +5.1% on average annually.

Employee Expectations – Benefits Remain Crucial

When reviewing career options, health care and related benefits remain a key element of job satisfaction and evaluation.

- According to statistics shared by the HR software firm, COMPT:

- 78% of employees say they are more likely to remain with an organization because of its benefits program.

- 41% of people say they’re likely to consider a new job if it offers better benefits.

- These numbers are even stronger among younger populations, with 57% of Millennials and 65% of Gen Zers saying benefits can sway their interest to a new organization.

- With regard to health care benefits specifically, the Society for Human Resource Managers (SHRM) reports that:

- 56% of U.S. adults with employer-sponsored health benefits said their satisfaction with their health coverage is a deciding factor in remaining at their current job.

- 46% said health insurance had either a positive influence or was a deciding factor for their original acceptance of their current work position.

Understanding Your Hiring Competition

When considering your competition, it’s important to understand what you’re up against. As reported by COMPT, those organizations planning to boost benefit offerings are most likely to increase:

- Health-related benefits (51%)

- Wellness (44%)

- Employee programs and services (39%)

- Professional and career development perks (32%)

- More leave, family-friendly and flexible working perks (28%).

It is worth noting that as people returned to offices following nearly a year or more of working remotely, we are seeing the value of some of these benefits, such as flexible work options, increase in importance.

Complications Compounded by COVID-19

“The great talent competition has been massively disrupted by COVID, with new ground rules for both candidates and companies,” said Jake Frazer, co-founder and president of Precision Talent Solutions. “The ‘wealth function’ for candidates has changed, shifting more value onto non-salary compensation components, such as work-life flexibility, insurance coverage, and retirement benefits. And for the savvy competitors on the hiring side, they are adjusting their total compensation offerings to candidates accordingly to attract the top talent.

In a survey shared by The Society for Human Resource Managers, recruiters say attracting top talent is their biggest challenge for 2021. This is despite an anticipated surplus of candidates – 80% of the adult labor force say they plan to explore new job opportunities in 2021.

Although this desire to find a new position may seem counterintuitive given the assumed value of still having a job post-pandemic, SHRM maintains that it is actually driven by new perspectives on employment after months of working remotely or in different ways due to COVID-19 safety protocols.

Even if you aren’t planning to expand your own employee roster, the reshuffling of positions that is likely to occur across the business landscape can lead to hiring needs at your own organization in the coming year.

“As the COVID situation thaws, those employers who do not adjust their total compensation for current employees, and to attract new talent, may find themselves losing great people to the competitors who adapt to this new reality,” said Frazer.

Becoming an Employer of Choice… on a Budget

Around the world, organizations are exploring health coverage revisions due to considerable price and inflation pressures. Yet the value of health care benefits to employee recruitment and retention means employers cannot design or modify a plan based purely on cost. Vital services must be maintained.

An international insurance broker can be your greatest ally during this process.

Creating a Tailored Plan: Reduce Costs While Adding Value for Employees

An annual review of utilization costs and an understanding of your own employees’ expectations are crucial. Even where health care choices are restricted by the government, more creative supplemental benefits can add value and improve employee retention.

Once you’ve been armed with this information, the ultimate goals during development of a tailored plan should be to:

- retain critical coverage, adopting cost-sharing measures as needed

- implement a more proactive approach to employee wellness

- offset the sting of any higher employee contributions to health care by adding creative, lower-cost benefits with a high appreciation value

Effective Health Care Cost Saving Options

Two of the most frequently implemented tactics that can deliver against the goals stated above are cost sharing and wellness programs. There are also opportunities that leverage technology or other workplace benefits to compensate for health care cuts elsewhere.

Cost Sharing

Retaining the valued elements of your existing health care program often requires a greater degree of employee cost-sharing. This is simply the reality of today’s health care environment. Member coinsurance is the most typical cost-sharing approach used in all parts of the globe – except for Europe, where socialized medicine distorts averages. Raising deductible amounts is also an increasingly popular cost-sharing option used by organizations worldwide.

Fortunately, if you communicate these changes in advance and can show what necessitates greater cost-sharing, you may curb employee dissatisfaction, even as personal health care spend rises. Best practices for effective implementation of any required increases include:

An option for “buy ups” to allow interested employees to increase a benefit that has been reduced, but they would like to maintain or even increase. This is one of the best ways to add flexibility without any financial drain on the organization.

Well-developed charts for easy comparison of plans if you are offering multiple benefit packages with different payment rates.

A self-serve resource available 24/7 to provide additional explanation of enrollment choices. Many brokers provide apps, a robust website, or a toll-free number, so be sure to take advantage of this valuable communication support.

A single individual or department – either internally or via your broker – to handle employee questions or concerns. You want consistent, well-informed advice being provided to everyone.

Wellness Programs

Globally, more employers are offering a range of wellness initiatives as a proactive approach to health care, with most claiming an ultimate goal of reducing health plan costs, while also boosting employee loyalty. According to data from Aon.com, employer participation rates worldwide by type of wellness programming offered are:

- Detection (90%) – The top options in this category are annual physicals, mammograms, and health and hearing screenings.

- Education (81%) – The most common are communication materials on wellness, wellness kits, informational web services, and fitness education.

- Wellness Interventions (79%) – The most popular offerings in this group are support for healthy eating, quitting smoking/tobacco use, physical activity, healthy weight, back care, and reducing risk for heart disease, as well as employee assistance programs.

- Advanced Assessments (72%) – This most frequently involves advanced check-ups and support related to heart health, nutrition, substance use, and level of fitness.

- Coaching (60%) – Guidance is most often provided by a health specialist or from a health coaching management system. Incentive programs are the third most popular offering in this category.

It’s important to recognize that finding a direct tie between a wellness program and health plan premium reductions can be elusive. Although the long-term health benefits of a wellness program may be assumed, it is nearly impossible to establish a direct financial payback. Instead, wellness program ROI may be better evaluated in relation to employee turnover and engagement, based on data from Forbes.com:

- U.S. employers lose over $1 trillion a year due to turnover. Replacing an employee can cost 33 – 150% of the employee’s annual salary, depending on skillset, and also impacts operations, lowers morale, and harms company competitiveness.

- Employees reporting high well-being are almost twice as likely to be engaged. Additionally, teams who score in the top 20% for engagement report 59% lower turnover and 41% less absenteeism.

- 56% of companies investing in employee engagement also enjoyed higher employee satisfaction, while 40% reported an enhanced company culture.

Of additional importance, wellness programs may hold growing appeal, as 74% of employees express new concern about at least one aspect of their wellbeing, either financial, social, mental, or physical (Source: Compt.io).

Alternate Employee Benefits

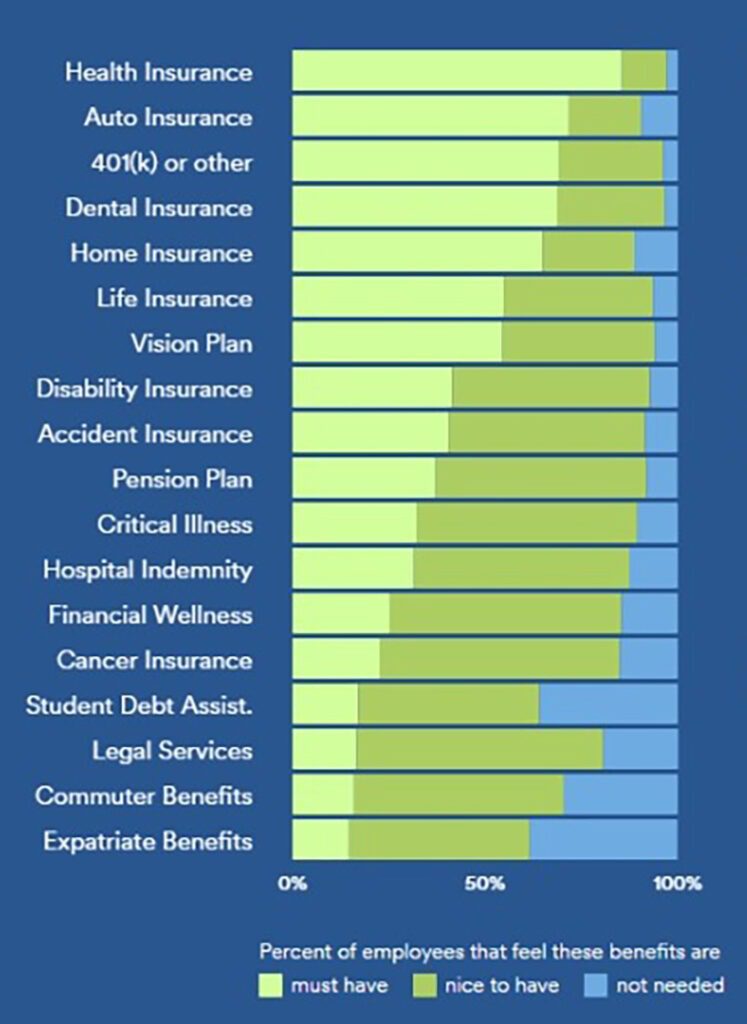

Employers are also increasingly leveraging new innovation and alternative benefits that deliver more but cost less. These oft-perceived “small” benefits can actually sway employee perceptions and improve overall employee assessment of total benefits, even as health care plans are altered. In fact, 69% of employees say their loyalty to an employer would increase with a wider range of benefits offered, according to Compt.io.

This makes these sometimes-overlooked solutions an important addendum to health care offerings.

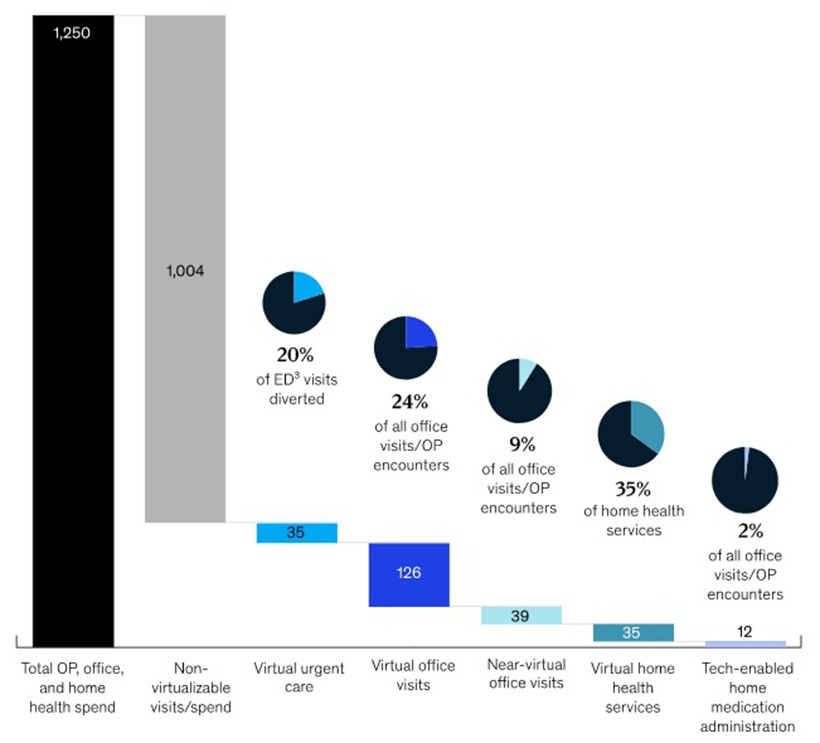

- Telehealth – The pandemic accelerated adoption of telehealth. Now, 74% of millennials prefer telehealth visits to in-person doctor exams, and consumers expect to make greater use of telehealth over the next five years. Importantly, telemedicine can reduce the costs of doctor visits by 10-15%, and the technology is projected to save $305 billion annually in just American health care costs (Source: GetStream).

- Flexible work options – Like telehealth, this perk was elevated by the pandemic, as both companies and individuals learned to navigate remote work options. Even before the pandemic, a survey revealed that 80% of employees say they would be more loyal to an employer if they were offered flexible work options. Another pre-COVID study of 10,000 employees found that a lack of work flexibility is the most likely reason a millennial would quit his or her job. The assumption is that both findings would be intensified as we return to work post-pandemic.

- Professional development – 80% of employees rank some form of continuous learning and professional development as “important” to “very important.” In addition, 70% of employees report being at least somewhat likely to leave their company for a new position at an organization known for its investment in employee learning.

- Innovative company benefits and perks – Even seemingly inconsequential offerings with little or no financial burden for the employer can hold significant sway on employee perceptions and should not be dismissed or overlooked. In fact, 48% of employees weigh innovative company benefits and perks –think availability of snacks, allowing pets at work, or flexible scheduling – in their decision to find their next job (Source: Compt.io).

A Successful Balancing Act – Reducing Costs While Retaining Employees

Employers can reduce health care costs in today’s competitive hiring environment through thoughtful plan design with an engaged insurance partner. The varied cost and pricing structures, wellness programs, and creative benefit offerings mentioned above should serve as a useful starting point for initial discussion and plan development.

Regardless of the broker or agency you select, you should demand an array of innovative choices, transparent pricing, and recommendations based on data analysis and your specific company geography and demographics. The key will be balancing cost restraints with the unique expectations of your own employees or prospects – the more information you have, the easier the selection will be.

After that, regular evaluation and ongoing adjustments should help you maintain a plan that remains relevant, affordable, and attractive to both current and potential employees.

Have Any Questions About Your Health Insurance Needs?

Do you have any questions regarding international group health insurance plans for your company? If so, reach out for a free consultation with a Clements insurance advisor who can discuss our flexible group health plans that are tailored to your needs, regardless of your organization’s size or location.

Gain insight on our customizable international group health plans

Clements Worldwide is an independent insurance broker with more than 70 years of international experience. We offer a full suite of personal and commercial insurance, including health benefits packages in more than 195 countries. To learn more about Clements’ customized global plans for expats, diplomats, and organizations, submit the form above, or contact us at info@clements.com or +1.800.872.0067.